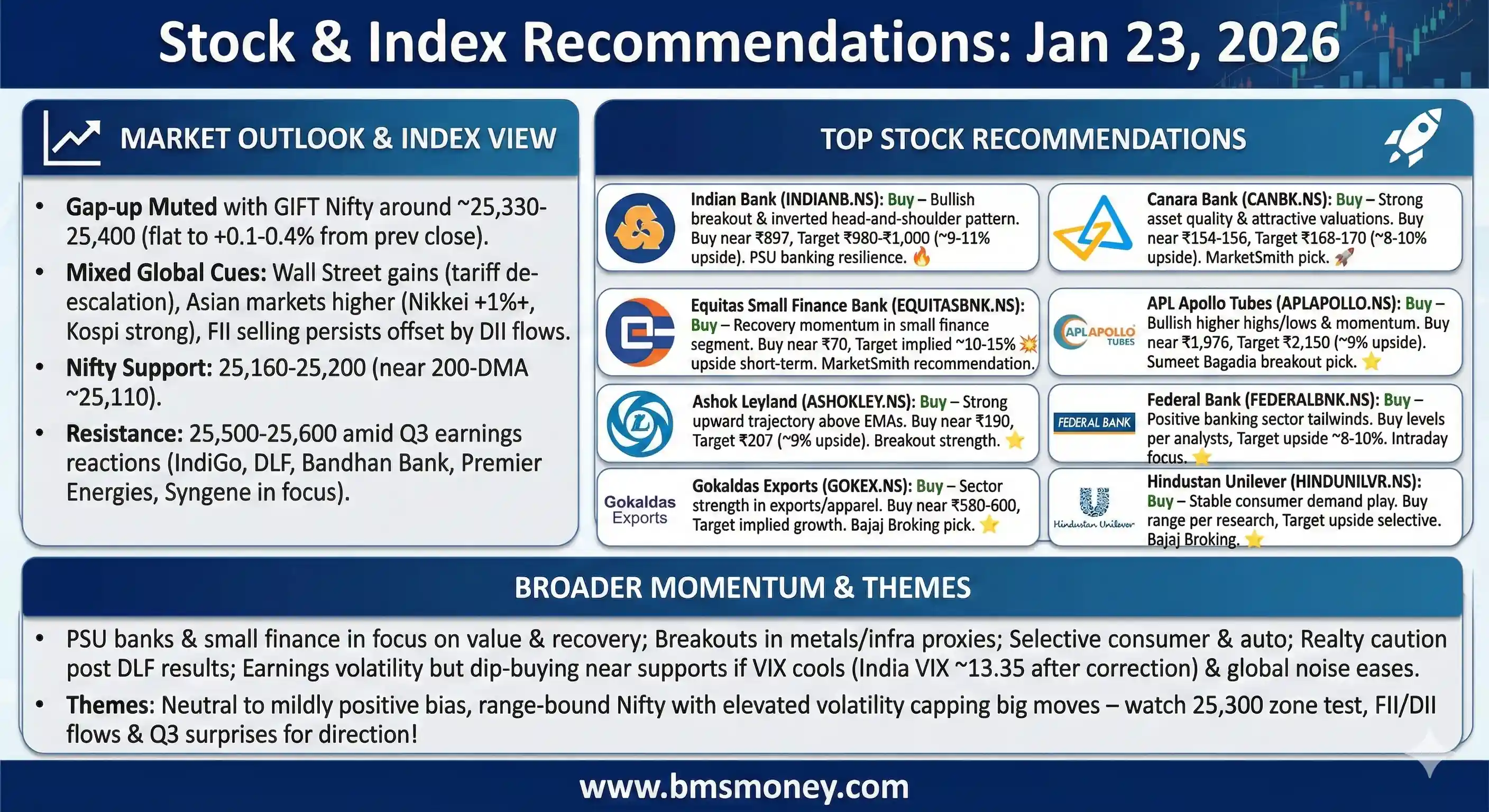

Indian equity markets are set for a positive opening on January 23, 2026, extending a relief rally fueled by easing global tensions and domestic buying in key sectors, despite ongoing FII outflows.

-

Opening Signal: GIFT Nifty indicates a strong, optimistic start, up approximately 0.87%.

-

Market Driver: A relief rally continues as global trade tensions show signs of easing.

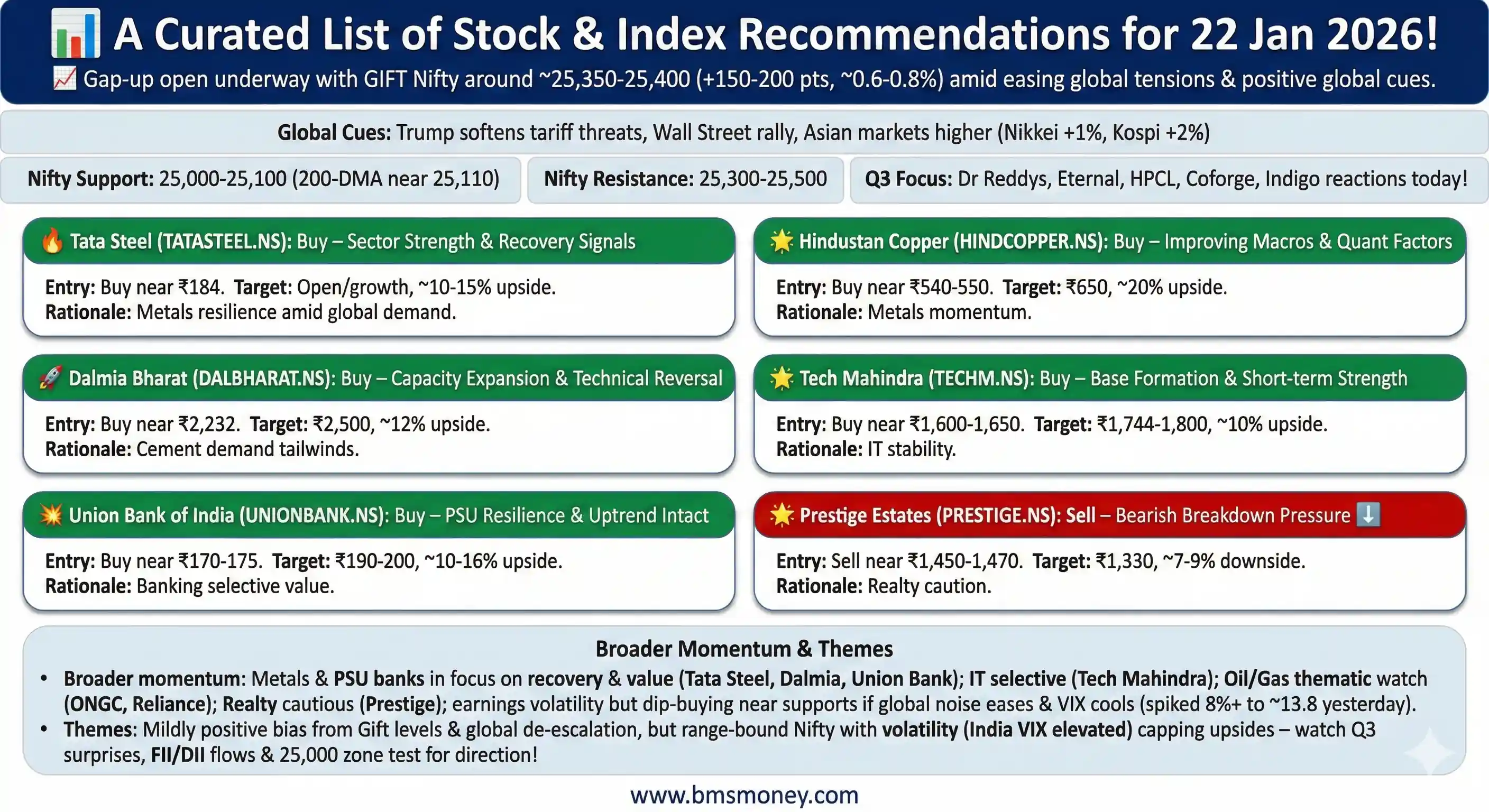

Indian markets anticipate a cautious, flat-to-positive opening on January 22, 2026, as stability attempts are challenged by geopolitical tensions, persistent FII outflows, and banking sector pressures.

Opening Signal: GIFT Nifty suggests a modestly positive start, offering marginal recovery from recent lows.

Market Stress: The market has faced selloffs in most January sessions, with elevated VIX indicating high volatility.

Sector Spotlight: Banking weakness on NIM pressures contrasts with resilience in the metals sector.

Key Picks: Union Bank of India, Tata Steel, and Dalmia Bharat highlighted for potential upside.

Prevailing Risks: Geopolitical tensions and sustained FII selling continue to cap meaningful gains.

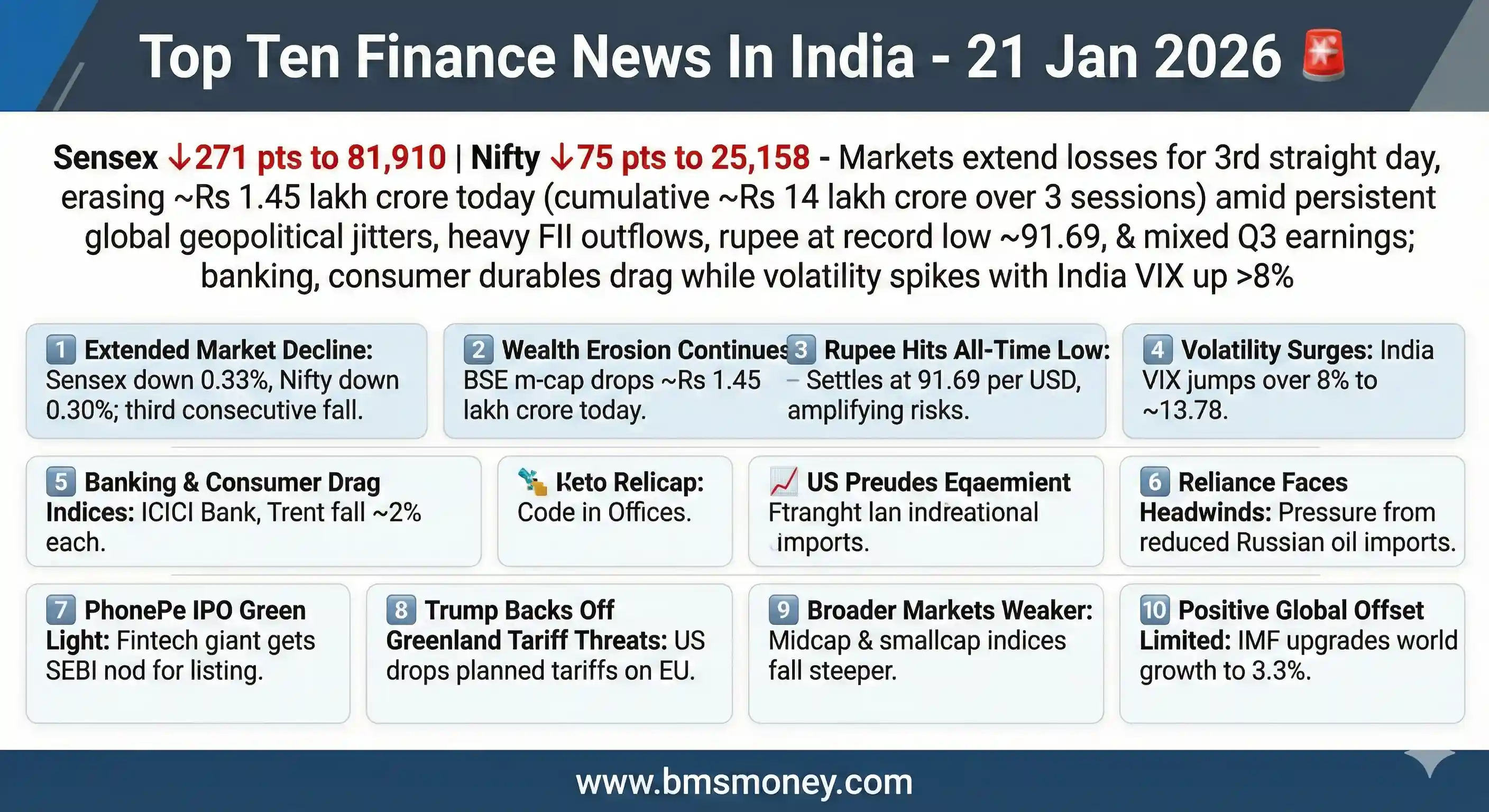

The Indian equity markets remained under pressure on January 21, 2026, extending losses for the third consecutive session amid persistent global geopolitical tensions, particularly US tariff threats, combined with ongoing foreign institutional investor outflows and a weakening rupee touching record lows. Overall sentiment stayed bearish and volatile, with broad-based selling across sectors despite some resilience in select large-caps and positive global growth revisions from the IMF offering limited offset.