Markets closed lower on January 19, 2026, amid heavy profit booking, weak Q3 earnings from heavyweights, and heightened global trade uncertainty.

Key Themes & Picks

-

Broad-based selling drags indices lower as heavyweight earnings disappoint.

-

Banking, IT, and energy sectors lead the decline.

-

Safe-haven demand pushes precious metals to record highs.

-

Escalating US trade policy risks weigh heavily on global sentiment.

-

FMCG shows defensive resilience amid the sectoral downturn.

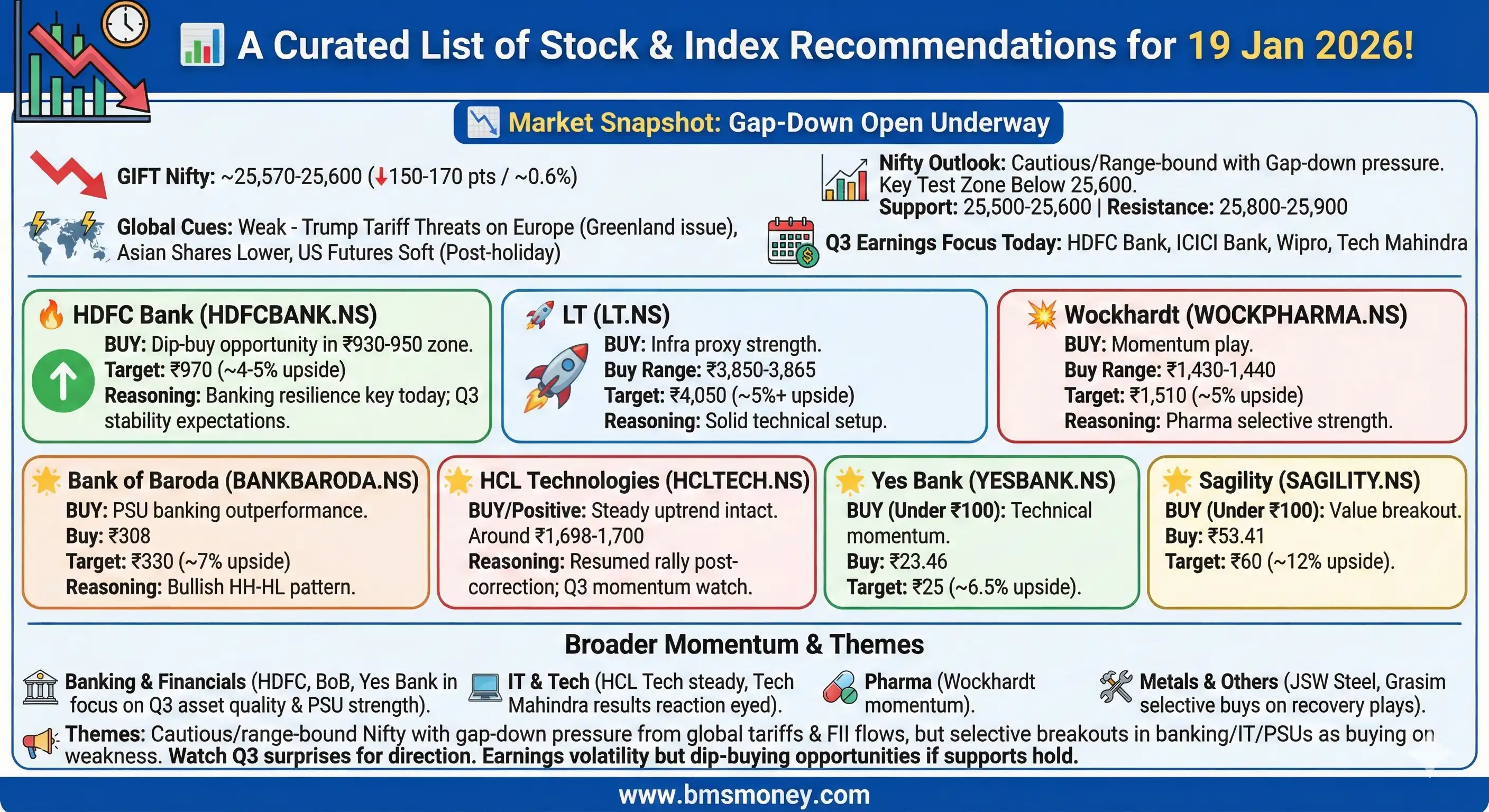

Indian equities open sharply lower on January 19, 2026, tracking weak global sentiment and pre-earnings caution, with GIFT Nifty signaling a significant drop.

Key Themes & Picks

-

GIFT Nifty indicates a sharply negative open, down 0.6–0.65%.

-

Key Q3 bank earnings (HDFC Bank, ICICI Bank) dominate market focus.

-

Selective buys in banking, IT, and PSUs advised despite the weak open.

-

Top picks: HDFC Bank, HCL Tech, and value plays in metals.

-

Renewed US tariff threats and elevated volatility add to caution.

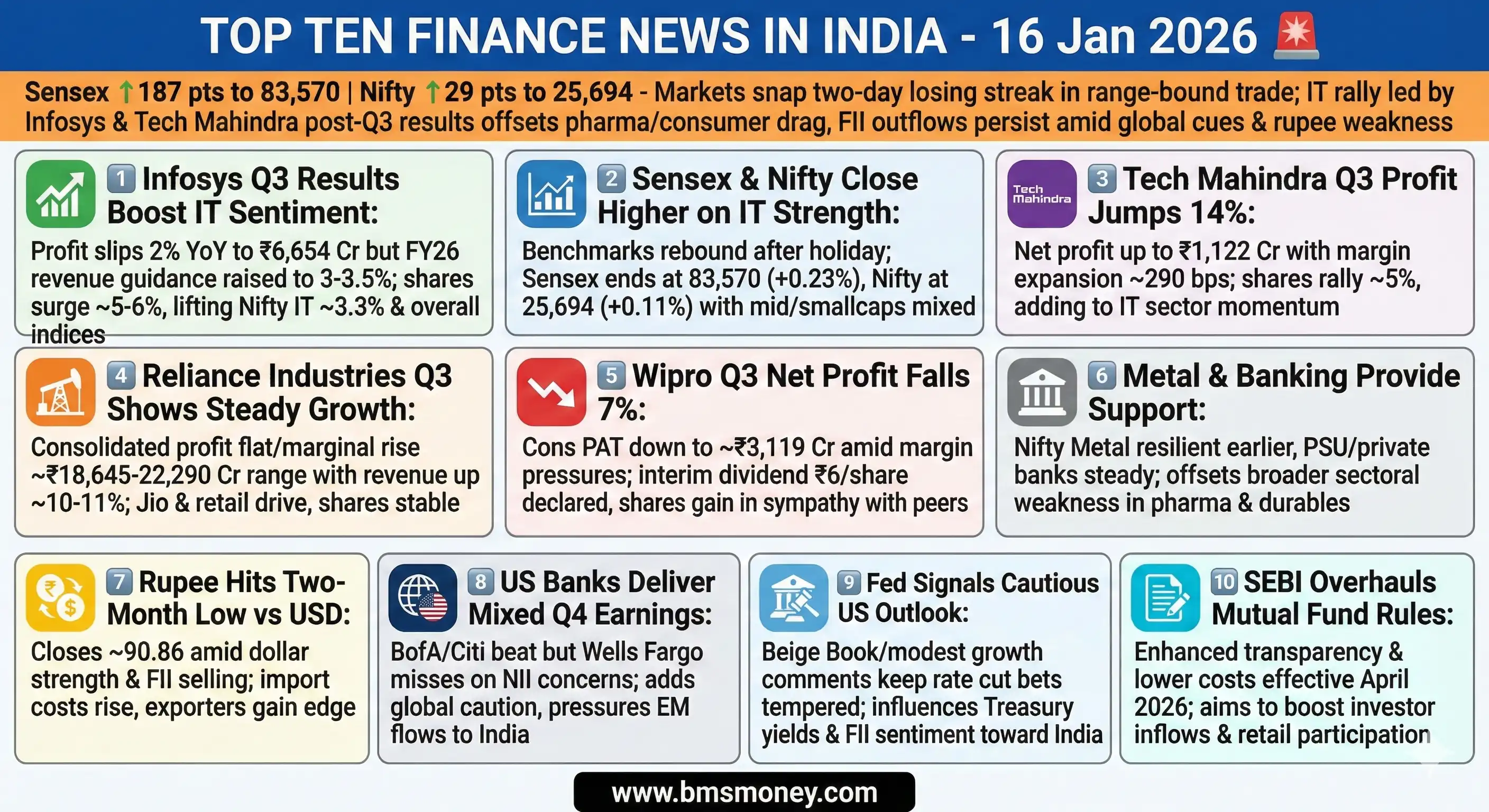

- IT sector led gains with Infosys surging over 5% post-Q3 results.

- Sensex rose nearly 188 points to close around 83,570 levels.

- Nifty settled near 25,694 after testing higher intraday.

- Reliance Industries posted flat profit but revenue growth of 10%.

- Banking and PSU stocks provided additional support to indices.