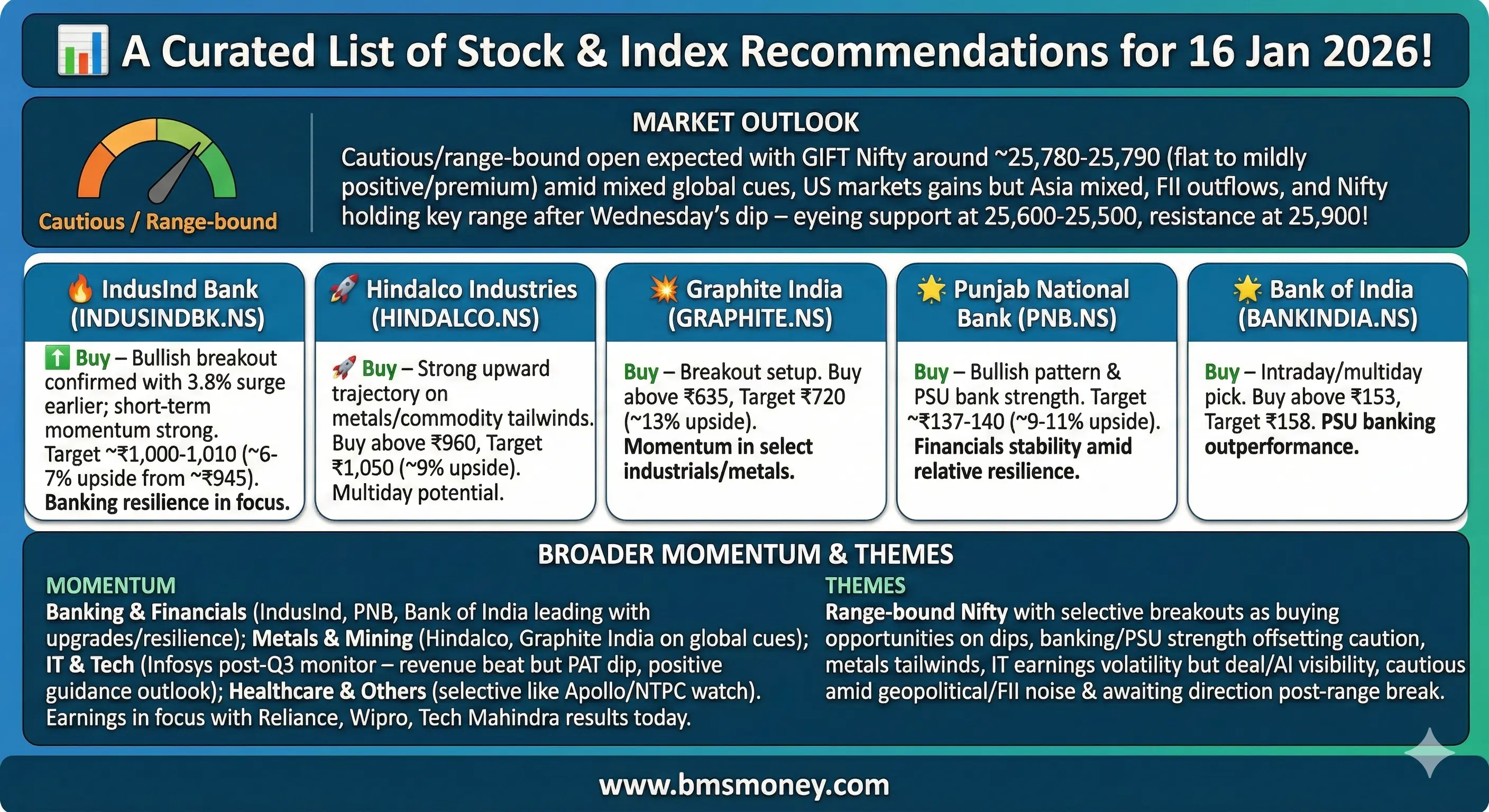

Indian markets resume trading after a holiday with a subdued, flat-to-negative start on January 16, 2026, as mixed global cues and key earnings shape sentiment.

Key Themes & Picks

-

GIFT Nifty signals a flat-to-negative opening post-holiday.

-

Key earnings from Reliance Industries and Infosys' guidance in focus.

-

Metals and banking sectors show strength on commodity tailwinds and upgrades.

-

Standout picks: IndusInd Bank, Hindalco, and Graphite India.

-

Range-bound trading persists amid persistent FII outflow concerns.

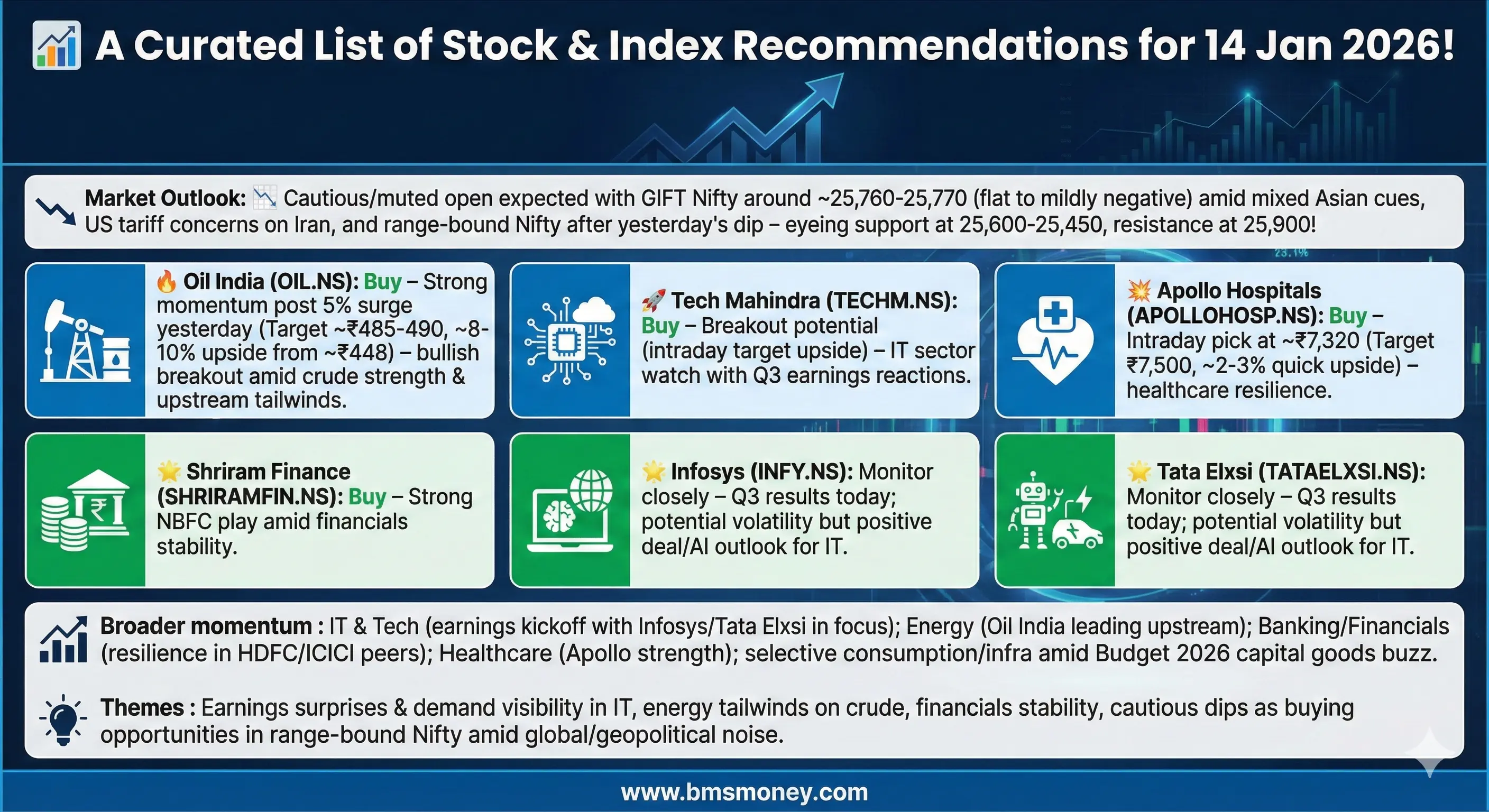

Indian equity markets extended losses for a second consecutive session on January 14, 2026, closing modestly lower amid persistent foreign outflows, geopolitical uncertainties, and mixed global cues. The Nifty 50 and Sensex declined around 0.26-0.29%, reflecting pressure from IT and consumption sectors despite resilience in metals and PSU stocks. Overall sentiment remained cautious with consolidation expected until key resistance levels are cleared.

Markets are set for a cautious, muted start on January 14, 2026, following mixed global cues and continued volatility, with a focus on key Q3 earnings.

Key Themes & Picks

-

GIFT Nifty points to a muted-to-slightly-negative opening.

-

Banking resilience and key IT earnings (Infosys) in focus.

-

Energy stocks see traction amid crude oil movements.

-

Key picks: Bullish outlook on Oil India and selected financials.

-

Persistent FII outflows may cap upside despite long-term optimism.