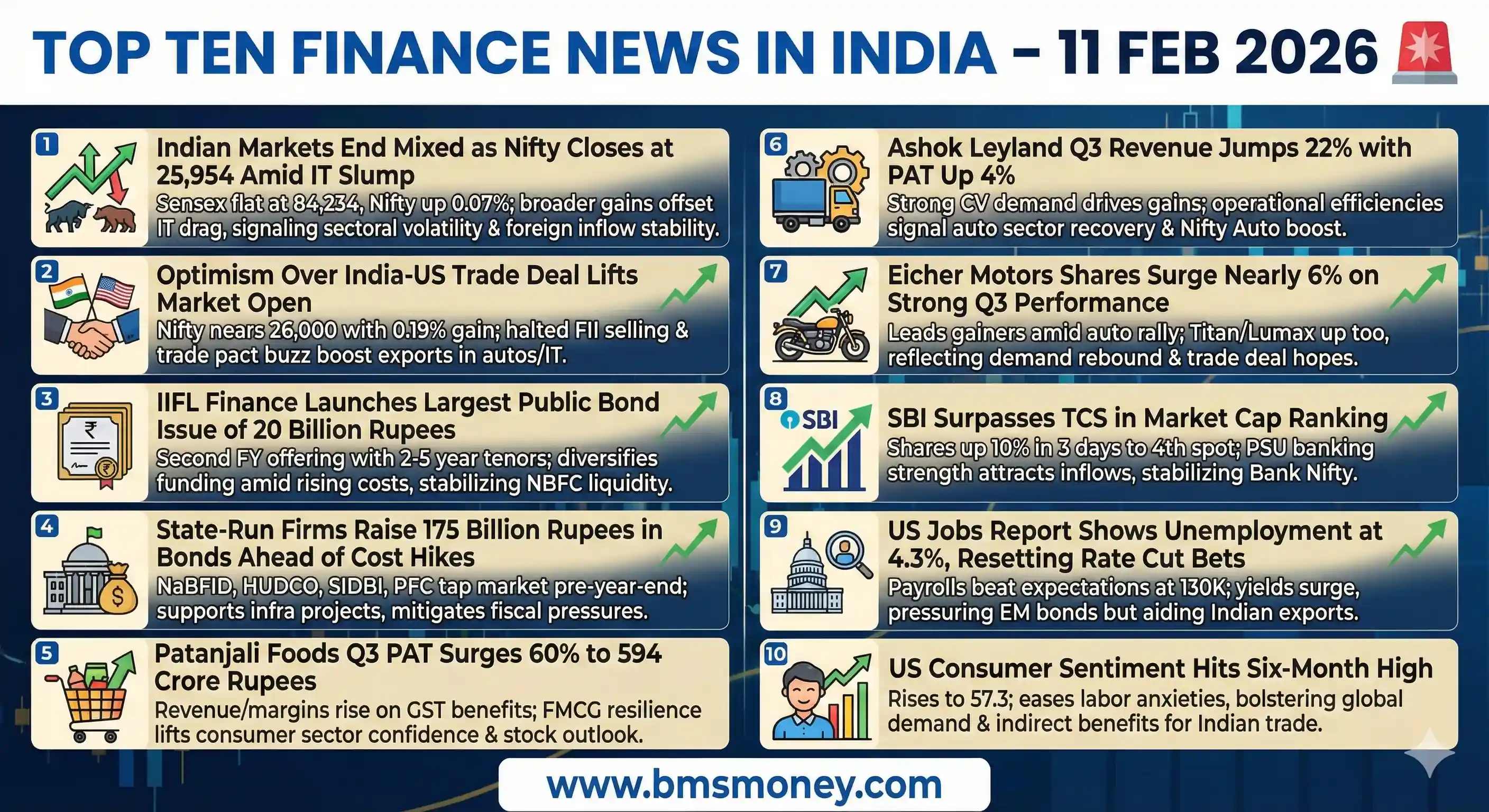

Indian markets closed flat but resilient on February 11, 2026, with the Nifty holding near 26,000 as strong auto and consumer earnings offset IT weakness and rising bond yields. Corporate fundraising and continued optimism around US trade talks provided selective support, keeping sentiment cautiously positive amid mixed global cues.

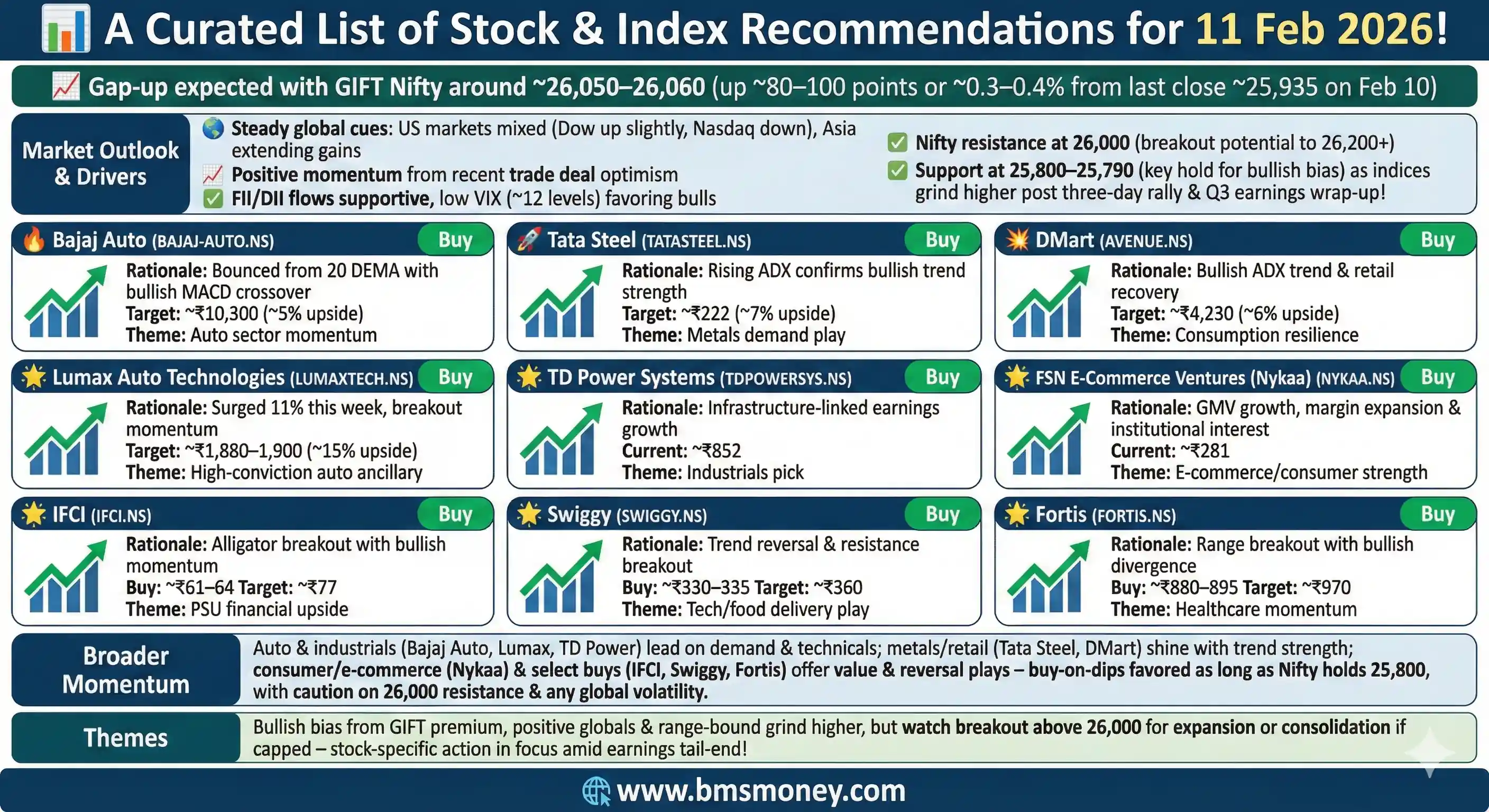

Indian markets anticipate a positive opening on February 11, 2026, supported by steady global momentum and sustained optimism from the US-India trade agreement. Key sectors like consumption, autos, and banking are expected to lead gains, driven by fresh bullish calls and resilient emerging market sentiment.

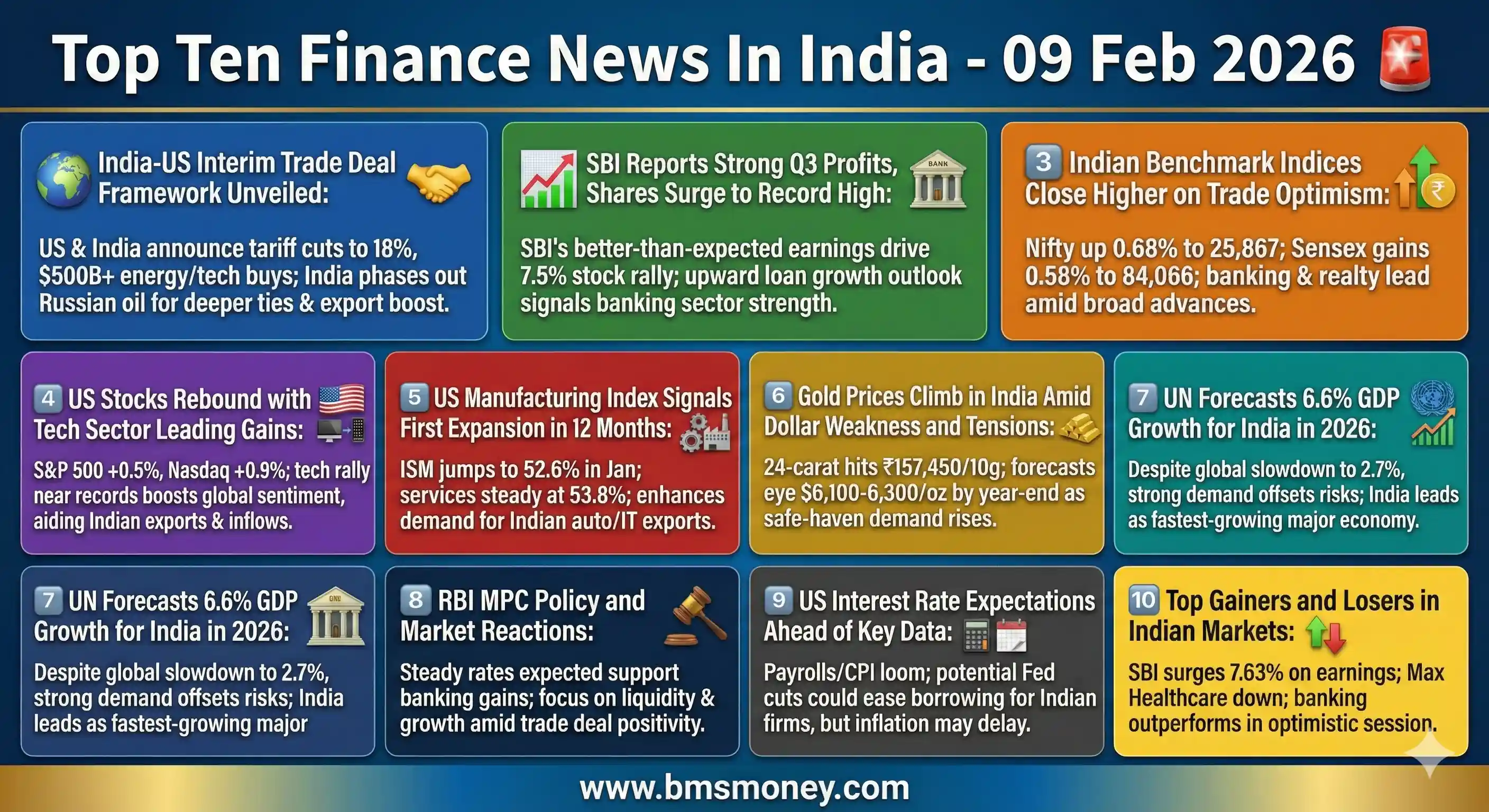

The Indian markets displayed a bullish sentiment on February 9, 2026, fueled by the announcement of an interim India-US trade deal framework and impressive quarterly earnings from State Bank of India. Positive global signals, including a rebound in US equities and robust manufacturing data, contributed to broad-based gains across sectors. Overarching themes revolved around enhanced bilateral trade relations, banking sector resilience, and optimistic economic projections amid geopolitical shifts.