Indian markets opened the week on a cautious note, tracking mixed global cues and lingering IT sector pressures from AI disruption fears. While the India-US trade deal offered support, a subdued GIFTNifty and selective sectoral resilience in realty, defense, and banking set the tone for a range-bound session.

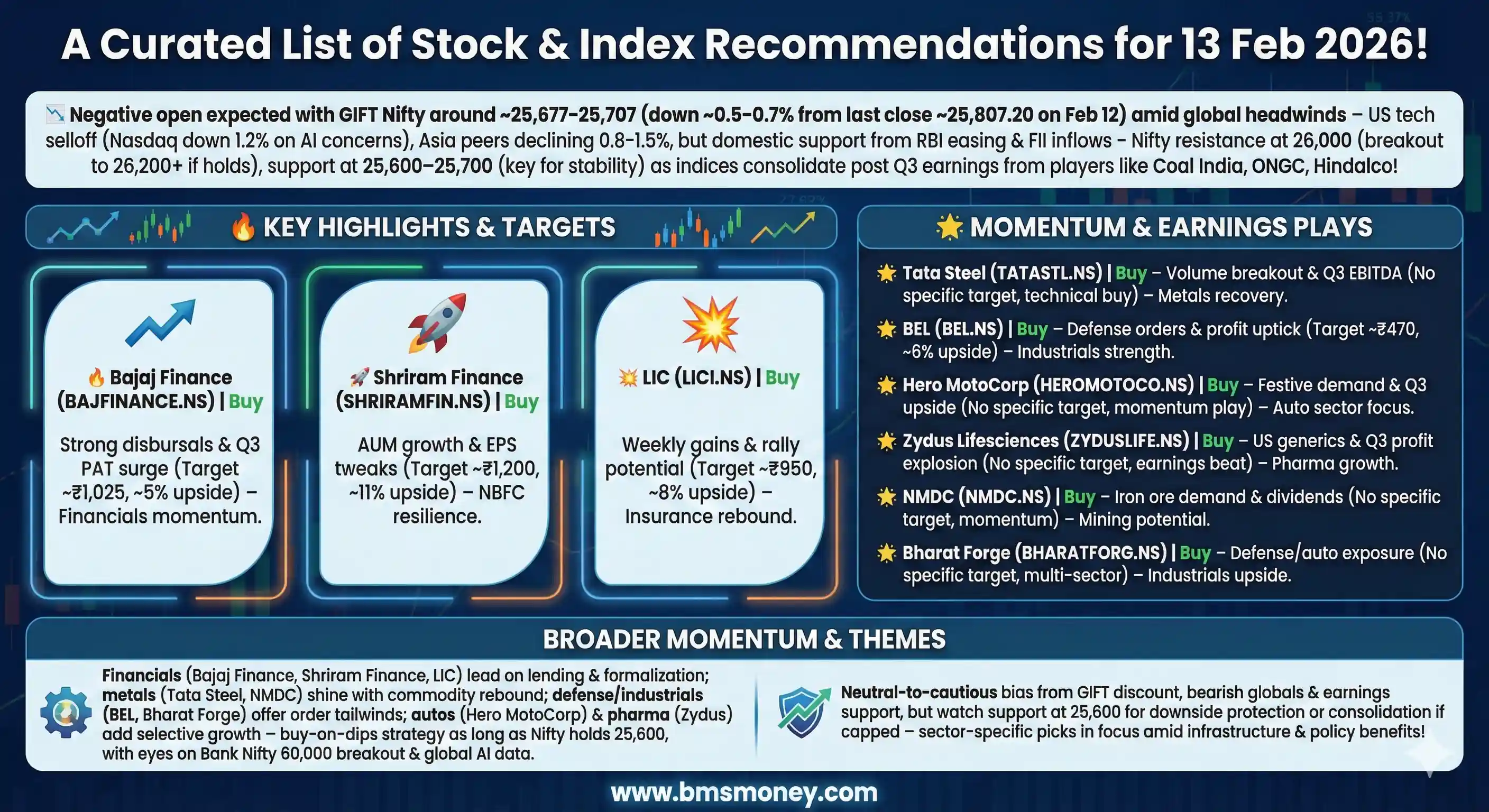

Indian markets are poised for a gap-down opening on February 13, 2026, tracking global weakness triggered by a sharp selloff in US tech stocks amid renewed AI disruption fears. Despite resilient domestic themes in defense, metals, and finance, global risk-off sentiment is likely to dominate early trade, with selective buying opportunities emerging in fundamentally strong pockets.

Indian markets closed lower on February 12, 2026, dragged by IT sector selling and global pressure from strong US jobs data delaying rate cut expectations. Positive domestic cues, including inflation easing back to the RBI's target band and major defense deal approvals, were overshadowed by broader risk-off sentiment.