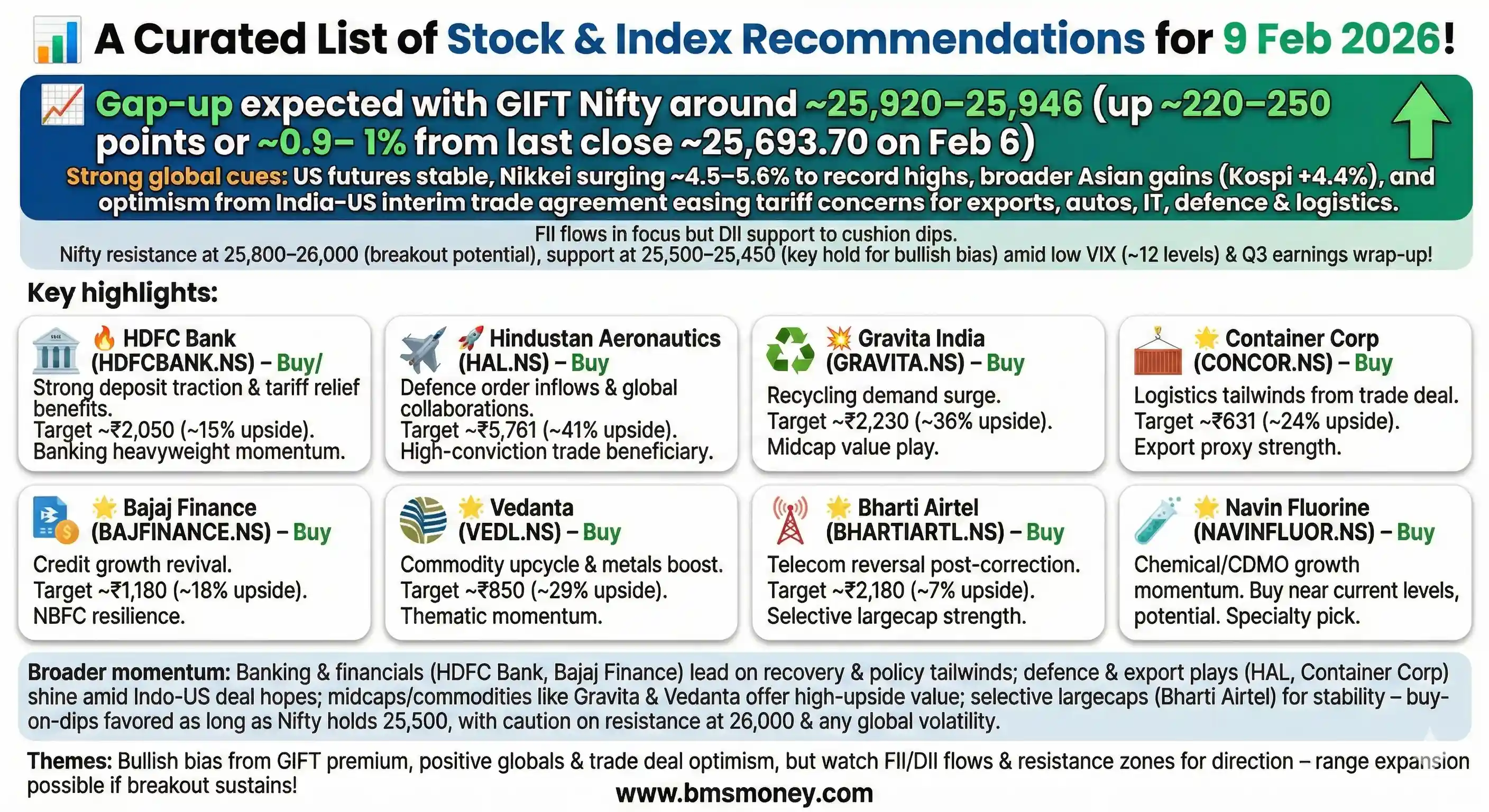

Indian markets are set for a powerful gap-up opening, buoyed by a historic Wall Street rally and fresh optimism from the new India-US trade agreement. A sharply higher Gift Nifty and strong global sentiment signal a robust recovery, with a focus on banking and export-oriented sectors poised to benefit from improved trade dynamics.

Indian equity markets closed lower in a volatile session on February 05, 2026, snapping a three-day gaining streak amid profit booking, weakness in IT and metal sectors, and cautious global cues from US tech declines. The bearish sentiment reflected broader caution following recent optimism on trade developments, with heavyweights dragging indices down despite some sector resilience and upcoming RBI policy focus on liquidity.

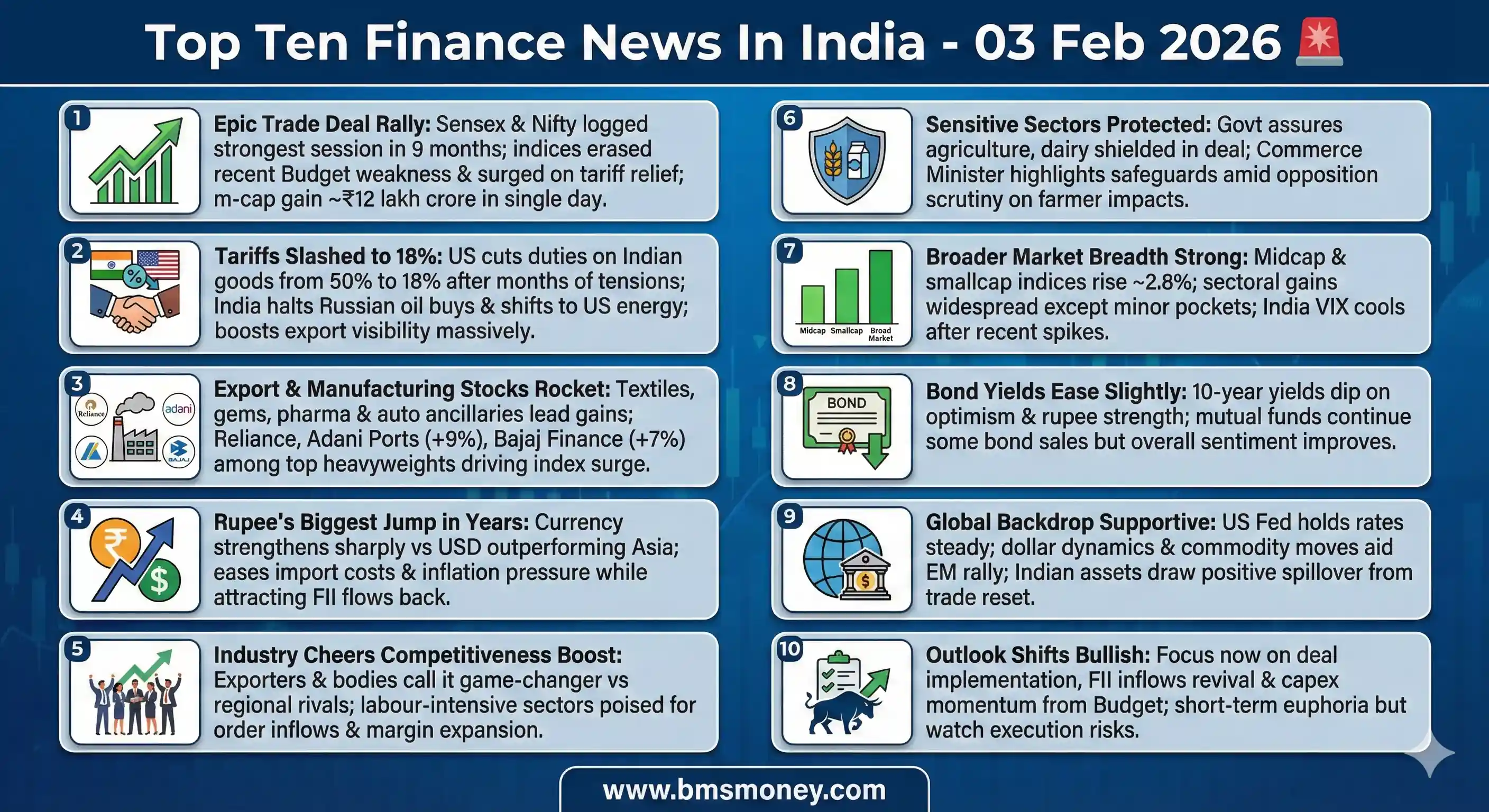

Indian markets surged in a historic rally on February 03, 2026, propelled by a landmark India-US trade deal that drastically reduced punitive tariffs on exports, providing a major relief from prolonged trade tensions and sparking a euphoric, broad-based buying spree that lifted the rupee and all major indices to record single-day gains.